Welcome to exNWA.com

Today's Date:

This site is dedicated to the Honorable people, those who did not cross the picket lines at Northwest Airlines, commonly referred to as SCABair. Now that Delta and NWA are one carrier, Delta now picks up the moniker of SCABair, because they employ the same SCABS that NWA did.

This site is intended for use by the Honorable. This is were the voice of the Honorable will be heard, along with other things of interest. This site is independently owned and operated and is advertisement, pop up and banner free. Enjoy. Make sure you refresh your browser to view the latest updates.

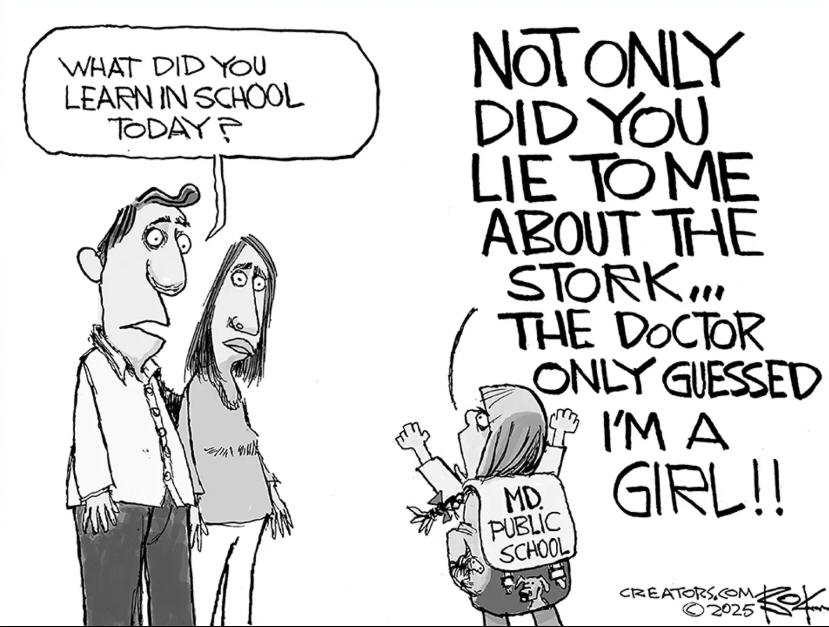

Image of the Day

Donate to exNWA.com:

Donating to exNWA.com is made easy by going to the "donate"

page. There you will find a PayPal link that makes it easy to donate.

One does not even have to be a member of PayPal to make a donation. Use

your charge card or send an electronic check. We appreciate any donation

you can make to keep this site on the internet. Of course your donations are

not tax deductible. This site survives on the generosity of our viewers.

Donating to exNWA.com is made easy by going to the "donate"

page. There you will find a PayPal link that makes it easy to donate.

One does not even have to be a member of PayPal to make a donation. Use

your charge card or send an electronic check. We appreciate any donation

you can make to keep this site on the internet. Of course your donations are

not tax deductible. This site survives on the generosity of our viewers.

Food for Thought...

"Be more concerned with your character than your reputation, because your

character is what you really are, while your reputation is merely what others

think you are."

- John Wooden